3 Mar 2026

Stress-free travel with your cat

Learn how to travel with your cat calmly and safely. Practical tips to reduce stress before, during and after...

Read more about Stress-free travel with your cat

GuidesPet insurance is a policy that helps you pay for vet bills when your cat or dog is unwell. Medical care for animals has come a long way which means there are so many options for sick or injured pets. With the right treatment, your pet’s quality of life can be massively improved, but the downside is that treatment is usually expensive.

Pet insurance will reimburse you for some of these costs depending on the policy you choose. The highest level of cover available is up to 90% of eligible vet bills covered1 – so if you paid a $1,000 vet bill, you can claim back up to $900 and reduce your out-of-pocket costs. Think of it as a way of keeping both you and your pet happy. Better health for them, and more money saved for you!

What’s interesting is around 39% of dogs and 32% of cats are older than seven years of age. For most cats and dogs, this would be classified as middle-aged or even senior, which puts them at a slightly higher risk of needing medical care.

| Animal | Household ownership rate | Total number in New Zealand |

|---|---|---|

| Dog | 34% | 851,000 |

| Cat | 41% | 1.2 million |

Source: Companion Animals in NZ Report, 2020

Most owners don’t think about the benefits of pet insurance until they’re suddenly faced with a large vet bill that could have been avoided. Whether you’re preparing for a new pet or looking for a way to reward your cat or dog for their loyalty, here’s why you might want to consider taking out cover.

If your pet gets sick or injured, it’s up to you to pay for their treatment. Even simple procedures like cleaning a wound can cost hundreds of dollars. Emergency treatment like surgeries or blood tests can save your pet’s life but vets often need to ask whether you’re willing to go ahead with them due to the huge cost. It’s heartbreaking that some owners need to say goodbye to their pets if they can’t afford the treatment.

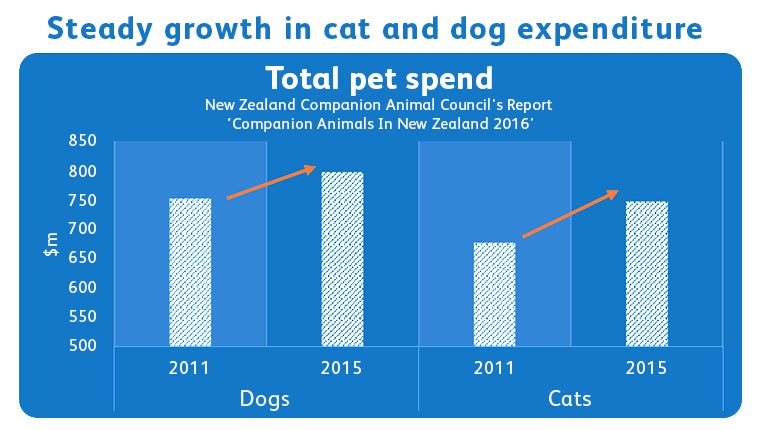

It’s easy to see why we end up spending so much on our pets in New Zealand. In recent years, dog owners have spent as much as $800 million caring for their pets, while cat owners have spent around $750 million.2

Read more about the costs and fees of pet ownership.

If you’re not keen on leaving potentially thousands of dollars aside in case of vet bills or you simply can’t afford it, then it may be worthwhile to look into pet insurance to avoid the financial headache.

Wouldn’t it be great if pets were creatures of habit and always followed our expectations? Maybe sometimes, but for most owners, the best thing about pets is their unpredictability. Cats and dogs are very good at keeping us on our toes and turning every day into an adventure, but it’s not always easy to keep up with them. If you’re someone who prefers order over chaos or you’re concerned about personal obligations coming up, pet insurance might provide you with some peace of mind.

For example, on top of covering unexpected vet bills, you can also get reimbursed for boarding costs if you weren’t able to take care of your pet for a few days. ‘Pet hotels’ or other pet-sitting services can cost between $20-$90 a day (depending on the needs and size of your companion).3 This can add up to a large bill if your cat or dog needed to stay for a long period.

The last thing you need during a personal emergency is to worry about finding a place for your cat or dog to stay (especially if you have a large dog who needs lots of space).

Your pet’s health isn’t something you should only think about when they’re sick or injured. Keeping your cat or dog healthy is a long-term goal that you should always be proactive about. You might think that small problems like sneezing or a rash don’t warrant a trip to the vet, but they could develop into something worse over time. Delaying medical care not only impacts your pet’s quality of life, it could lead to needing more invasive or expensive treatment down the line.

The benefit of pet insurance is that you can get reimbursed for eligible vet consultations any time you’re unsure about something (annual limits may apply). If your pet develops minor symptoms, these can usually be treated with medication before they cause any real discomfort. If you really want to look after your pet’s health without worrying about the costs adding up, then this might help you figure out if pet insurance is worth it.

Pet insurance is fairly simple to sign up for. Most breeds of cats and dogs can be covered as long as they’re between 8 weeks and 9 years of age depending on level of cover you choose. All you need to do is decide how much cover to take out by considering the needs of yourself and your companion.

| Features |

|---|

| Check if your pet meets the eligibility criteria |

| Compare quotes and benefits from different providers |

| Read the Policy Document |

| Features |

|---|

| Choose a level of cover that suits you |

| Apply for a policy online or over the phone |

| Choose how you will pay the premiums – fortnightly, monthly or annually. |

| Features |

|---|

| Once your policy is set up, your pet is covered for eligible accidents and injuries right away |

| Waiting periods may apply for illnesses or cruciate ligament conditions. |

| Enjoy your pet’s freedom to be themselves and not have to worry about vet bills! |

Pet insurance reimburses a portion of your eligible vet bills depending on your level of cover. The table below shows some of the great benefits under each policy. For a full list of product features, check out SPCA Pet Insurance.

You should always read up on the Policy Document to find out exactly what you’re covered for. Pet insurance usually covers two specific types of events.

| Accidental injuries include thing like | Cover for illnesses includes |

|---|---|

| cuts, bites, or other wounds | a typical sickness or disease |

| trauma (such as a fall or car accident) | tick paralysis |

| bone fractures | joint conditions such as hip dysplasia, intervertebral disc disease, and arthritis |

| snake or insect bites | gastrointestinal problems (vomiting, diarrhea, constipation etc.) |

| burns | skin conditions |

| surgical treatment if your pet swallows a dangerous object. |

For the best possible cover, you could consider a policy that covers both accidents and illnesses, such as SPCA Pet Insurance.

It’s important to keep in mind that pet insurance doesn’t automatically cover everything. If your pet gets sick within 21 days of signing up, this may be classified as a pre-existing condition that you won’t be covered for. There’s also a 6-month waiting period before you can claim on cruciate ligament conditions, but you can apply to have this waived.

As a general rule, pet insurance is designed to cover unexpected medical costs that you aren’t able to plan for. This means that ongoing expenses like food or vitamins are not covered. Experimental treatments or major cosmetic/lifestyle changes are also excluded.

Common events that you can’t claim on include: